Accounting Automation Software for Small Business: A Comprehensive Guide

Accounting Automation Software for Small Business: A Comprehensive Guide

Estimated reading time: 5 minutes

Key Takeaways

- Accounting automation software can significantly streamline financial operations for small businesses.

- Key features include invoicing, expense tracking, payroll management, and AI-driven insights.

- Top software options like QuickBooks, Xero, and Wave offer tailored solutions for small businesses.

- AI capabilities in accounting software enhance efficiency through predictive analytics and fraud detection.

- Selecting the right software involves matching business needs, budget, and essential features.

Table of contents

- Accounting Automation Software for Small Business: A Comprehensive Guide

- Key Takeaways

- What is Accounting Automation Software?

- Benefits of Accounting Automation

- Key Features to Look For

- Top Accounting Automation Software

- Best Invoicing Automation Tools

- Automating Expense Tracking

- Payroll Automation Software

- The Role of AI in Financial Management

- How to Choose the Right Software

- Success Stories

- Conclusion

- Call to Action

- References

In the fast-paced digital age, small businesses are increasingly turning to accounting automation software to streamline their financial operations. This guide explores how such software can transform your business, offering insights, comparisons, and recommendations to help you make informed decisions.

What is Accounting Automation Software?

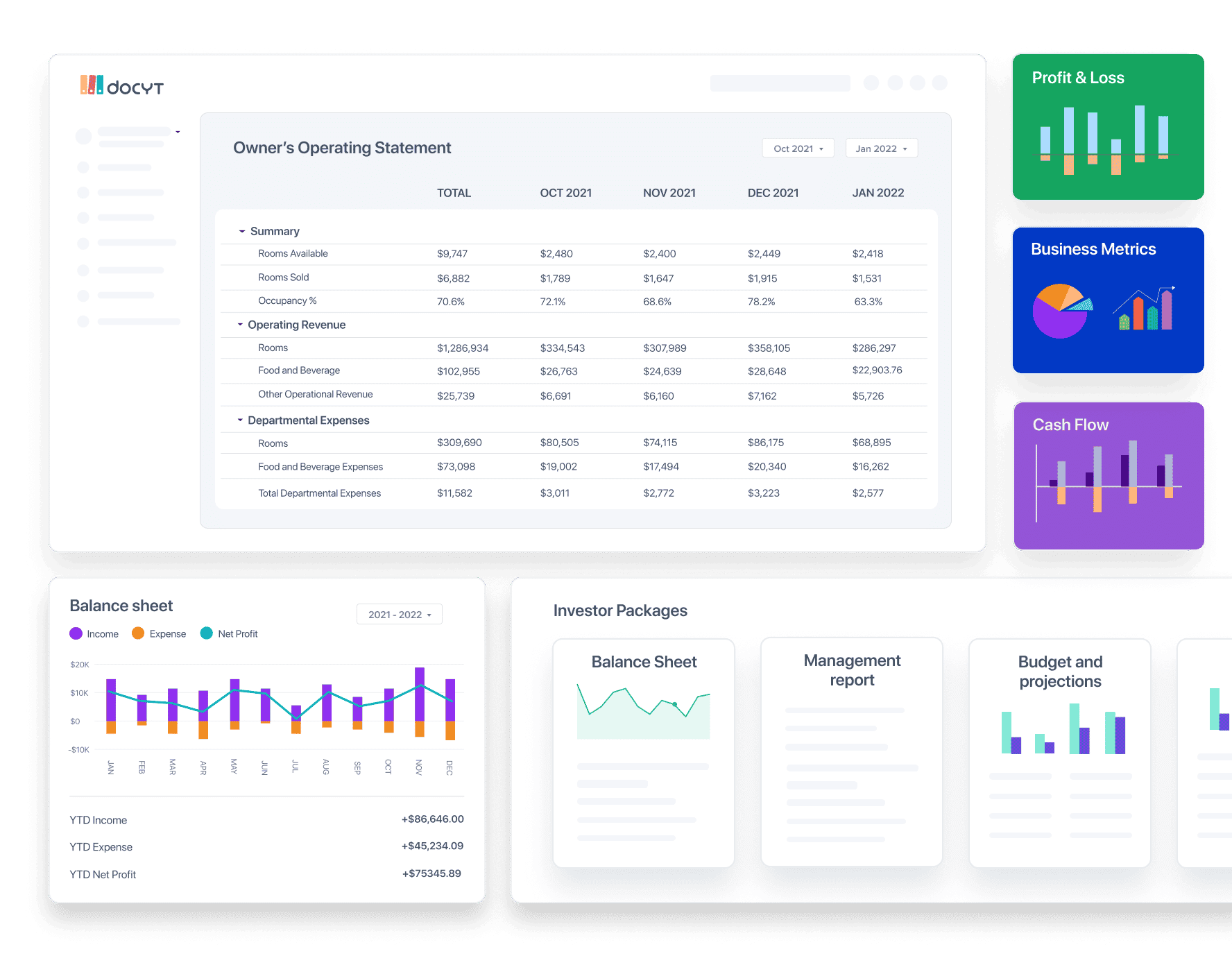

Accounting automation software is designed to automate financial tasks, reducing manual effort and errors. Key features include invoicing, expense tracking, payroll management, and financial reporting. Advanced software now integrates AI for predictive analytics and fraud detection, enhancing efficiency and accuracy.

Benefits of Accounting Automation for Small Businesses

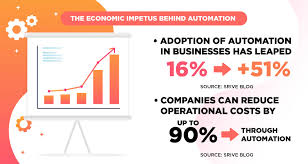

Implementing accounting automation offers numerous advantages. It saves time by automating repetitive tasks, reduces errors, and provides real-time financial insights, enabling informed decision-making. These tools are essential for small businesses aiming to stay competitive and efficient. The Benefits of Automation for Small Businesses

Key Features to Look For

When selecting accounting automation software, consider these essential features:

- Invoicing Automation: Automatically generates and sends invoices, tracking payments and providing detailed reports.

- Expense Tracking: Categorizes expenses, creates reports, and integrates with accounting software.

- Payroll Automation: Streamlines payroll processing, ensuring timely and accurate payments.

- Integration Capabilities: Ensures seamless operation by integrating with other business tools like CRM and ERP systems. The Best CRM Automation Tools for 2024

- AI Capabilities: Offers predictive analytics, fraud detection, and automated data entry, boosting efficiency.

Top Accounting Automation Software

Explore the top solutions for small businesses:

- QuickBooks: Known for its user-friendly interface and comprehensive features, including invoicing and payroll management. Pricing starts at $25/month.

- Xero: Offers robust financial reporting and seamless integration with other tools. Ideal for businesses needing advanced features.

- Wave: A cost-effective option with features like invoicing and expense tracking, suitable for small businesses and freelancers.

- FreshBooks: Ideal for freelancers and small businesses, offering time tracking and expense management alongside invoicing.

Best Invoicing Automation Tools

Effective invoicing is crucial for cash flow. Top tools include:

- FreshBooks: User-friendly with features like time tracking and expense management.

- QuickBooks Online: Offers powerful invoicing integrated with accounting software.

- Zoho Invoice: Affordable with features like recurring invoices and payment reminders.

Automating Expense Tracking

Efficient expense management is vital. Consider these tools:

- Expensify: Cloud-based, integrates with accounting software, and offers receipt scanning.

- Receipt Bank: Automates expense tracking with features like receipt scanning and categorization.

- Concur: Robust for both small and large businesses, offering detailed reports and analytics.

Payroll Automation Software

Streamlining payroll ensures timely payments and compliance. Top choices include:

- Gusto: User-friendly with HR and benefits management features.

- ADP: Comprehensive solution for payroll, tax compliance, and employee self-service.

- Paychex: Trusted for its reliability and range of tools, ideal for small businesses.

The Role of AI in Financial Management

AI is revolutionizing financial management with features like predictive analytics, fraud detection, and automated data entry. Software like QuickBooks now incorporates AI, offering predictive insights and automated recommendations.

How to Choose the Right Software

Selecting the right software involves considering:

- Business Needs: Match software to your business size and complexity.

- Budget: Consider pricing, ensuring it aligns with your financial capabilities. Cost of Automation for Small Business

- Features: Identify essential functionalities like invoicing or payroll.

- User Reviews: Check ratings and feedback for insights into usability and support.

- Customer Support: Ensure the software offers adequate support and training. Best Tasks to Automate in Small Business

Success Stories

Real-world examples highlight the benefits. For instance, ABC Company reduced accounting errors by 40% and saved 10 hours weekly by automating invoicing and expense tracking.

Conclusion

Accounting automation software is a necessity for small businesses aiming to enhance efficiency and accuracy. By automating tasks, businesses can focus on growth. Start exploring these tools today to see the transformative impact.

Call to Action

Have you experienced success with accounting automation? Share your story in the comments. Subscribe to our newsletter for more insights on business automation and financial management.